Athon Slotkin:

Athon has earned the title of “The Shadow CEO” by working with thousands of businesses to adjust business strategy, see the big picture, make innovative brand or financial moves, and pivot accordingly to market developments. He is currently working with several startups on the NFT market.

Roham Gharegozlou:

Roham is the CEO of Dapper Labs. Dapper Labs is partnered with on NBA Top Shots, Dapper Labs latest product line. Investors in Top Shot include Michael Jordan and Kevin Durant. His first blockchain product, CryptoKitties, is the world’s most successful blockchain game.

Dean Christensen:

Dean is a figurative painter living and working in Brooklyn, NY. Christensen has received numerous prestigious awards including Best of Show, First Place Professional Painting, and the Purchase Award at the Kentucky Museum. In addition to his own original work, Dean has worked as a primary artist on creating the Top Shop line of NBA-endorsed NFTs.

https://www.ndeanchristensen.com/

Zachary Winterton.

In addition to working with Dean on NBA Top Shots, Zachary has created his own set of favorite dunking hoopers as unique, collectible crypto characters in the Crypto Dunks Collection.

https://opensea.io/collection/cryptodunks-collection

It all began in August of 2008 when someone registered the domain name bitcoin.org. Later that year in October, a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System was published on a mailing list focusing on cryptography. In January 2009, Nakamoto released a bitcoin client app and issued the first transactable bitcoins And just like that, sigh, yes, I know, I know, another paradigm shift appeared in the wonderful world of technology.

Bitcoin is literally virtual gold. (Yes, the irony is deliberate.) We’re not going to go into the details, but to obtain bitcoin you must “search” for it in an algorithmic mine. Instead of a pan and pickaxe, you sift through a substrate of encrypted algorithms to uncover each virtual gold bar. Once found, each bar is registered automatically in an encrypted, decentralized public ledger called the “blockchain.” Nakamoto only created 21 million coins and to date about 19M have been “mined” When the rest are unearthed, that’s it, though each bitcoin can be broken down into an unlimited number of units called bitcash, whose transfer is also recorded in the blockchain. Many companies have jumped into the virtual currency game and we have no intention of guessing at this time who the ultimate winners and survivors will be at this point.

The significance of bitcoin is that it has the potential to replace and integrate the world’ s finances. The currency has many advantages. In theory, transactions can’t be destroyed or altered. There goes North Korea’s profitable counterfeiting business. Because it’s digital, a universal exchange rate can be established. And, in theory, bitcoin is inflation proof. More on that shortly.

“But bitcoin doesn’t really exist,” I hear you say. “It’s about as real as monopoly money.” An excellent point and I concede it. I’ve never held a bitcoin in my hot sweaty hands and neither have you. Bitcoins are abstractions supported by belief.

Now, take a dollar out of your pocket and look at. You can hold it, certainly. And all of us have held one sort of precious metal at one time or another. Today, people use dollars to establish prices, pay off debt, run markets, buy stuff. But what “backs” a dollar. How is its value established?

Before the Great Depression, the answer was often via gold or silver. You could walk into a bank, hand over a greenback to a teller and receive in turn a gold or silver dollar. Since the Pyramids, humans have prized both and accepted their inherent value.

After the Great Depression, gold and silver went away for decades. If you went into a bank and handed a teller a dollar and asked him to back it, he’d hand the dollar right back to you with a cheery assurance that your greenback was backed by “the full faith and credit of the United States.”

This system worked out well for a long time, but ominous tides are rising. Today, the U.S. national debit has reached $28T (as in trillion) in funded liabilities (in other words, in theory a budgetary source exists for all the money we owe) and $80T to 90T (but hey, who’s counting) in unfunded liabilities, money we’ve said we’ll pay you back someday though we don’t have clue where the bucks will come from but, hey, we’re the government. Trust us. If we have to, we’ll just print some more money! Which, by the way, is exactly what the U.S. government proposes to do by adding another $20T?, $30T?, $40T?, but who’s counting? to the national debt.

In other words, each and every one of us is on the hook for about $330K if the bills come due. And inflation, which is what happens when you print money without any underlying monetary activity and growth to support it, is returning (just check the price of gas and keep an eye on your roll of toilet tissue. You’ll find the number of feet per roll starting to shrink while the price remains the same. One of those little tricks businesses learned during the Carter administration). The 2020s are calling back for the 1970s economy back.

So you tell us. Which currency is more like monopoly money? The U.S. dollar or bitcoin?

Certainly, the market seems to be crushing on bitcoin. The first two bitcoins were sold in return for a couple of pizzas. Today, a single bitcoin is worth about $30K and I mean today. Bitcoin is traded as a commodity and is subject to wild swings, as commodities always are. (No, I’m not going to address the other virtual currencies. Another day).

Ththe dollar and other currencies do have one huge advantage over bitcoin and its friends such as Ethereum. The dollar is “legal tender” for all debts, public and private. IOW, if I owe you $10 bucks, pull out a tenner, and hand it to you, you must accept it. You can’t slap my hand away, take me to court, and complain I didn’t hand you a pouch of gold dust worth $10.

Bitcoin is in the same position. You don’t have to accept my $10 worth of bitcoin. But increasing numbers of companies are. So many that we may have crossed over the “inevitability” line. Today you can pay your phone bill to AT&T with bitcoin. Attend a Dallas Mavericks game. Buy a mobo from NewEgg. And the list is growing.

The above was a necessary introduction to the wide and wooly world of NFTs, non-fungible tokens. An NFT is a single-purpose blockchain entry into a digital ledger, a one-time transaction that cannot be replicated and withdrawn. NFTs first began to penetrate the public conscious when headlines such as these spread across the internet:

“’Disaster Girl,’ The Stuff Of Memes, Sells For Nearly $500,000 As NFT”

“Disaster Girl” is a picture taken in 2007 of four-year-old Zoe Roth watching her Dad participate in a fire control exercise carried out in North Carolina. In the picture, no actual house is being burned down and no one is hurt. Zoe knows this, and this explains her quizzical expression.

Something about the child’s demeanor caught the fancy of the internet, and Zoe soon became a meme. Her expression was superimposed across pictures of the world undergoing nuclear annihilation, death by giant spiders, the Titanic sinking, etc., etc. Anyone could download a digital copy of the original photo and all its variants. You can do so today, with every pixel of the first posted image intact. Hundreds of millions, maybe billions, of people have seen this image.

Zoe is not the only beneficiary of NFT largess. In 2007, Howard Davies-Carr, a U.K citizen, posted a video of his baby son chomping down on his older brother’s finger. As with Zoe, the video went viral and hundreds of millions have seen and enjoyed it. It all paid off; in May of 2021, “Charlie Bit My Finger,” sold for $760,999 as an NFT.

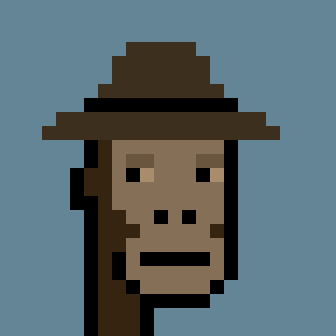

It’s not only Zoe and Charlie who are benefiting from NFT goodness. Jack Dorsey sold his first tweet for $2.9M (he says he gave the proceeds to charity). One of Larva Labs digital pieces of art named CryptoPunk 6965, one of a 10K set of images published in 2017 that look like…uh…punks, sold for $1.54M. It’s the featured image on this page and looks like it escaped from a late 70s Atari original game console. ) 6595 is worth all that money because “…CryptoPunk #6965 is one of the Ape species. It also comes with a Fedora as an accessory. More so, only 186 punks have Fedoras, and there are only 24 Ape punks.” (If you’re having a bit of trouble with this concept, think back to the 90s and the Beanie Baby craze.)

To date, the current king of NFT monetization is Mike Winkleman know professionally as “Bepple”, whose pieced entitled “Everydays: The First 5000 Days” sold at auction at Christies for $69, 346, 250M. (No, that number is not a typo.) The picture consists of 5,000 images assembled over 13 years. The auctionstarted with an opening bid of $100, with 350 prospective buyers pushed the final price to truly Olympian heights. The sale included display rights, but not copyright.

There are five factors that determine the worth of a piece art, regardless of the medium in which the work was created. They are:

Authenticity

Can you prove the artist accredited for the work is indeed the creator?

Celebrity

How famous is the author? After his death in 1675, Vermeer fell into an obscurity from which he only escaped in the 19th century. Until then, a Vermeer painting could have been purchased for a few thousand dollars (adjusted for inflation), and only for the very best known works. Today, Vermeers are priceless. “Girl With a Pearl Earring,” if ever put up for sale, would be worth several hundred million dollars. Over a billion is not out of the realm of possibility.

Quality

How good is the artwork? This is highly subjective in some cases. Not in others. No one disputes that Michelangelo’s Sistine Chapel is a masterwork of civilization. A CryptoPunk doesn’t live in the same quality universe. (But some of them do have fedoras.)

Scarcity

One of the reason for the incredible price of Vermeers is that there are so few of them. Today, there are about 30 authenticated Vermeers, with a handful in dispute. On the other hand, Picasso was amazingly prolific and later in life got in the habit of scribbling sketches, doodles, and even his increasingly shaky signature on napkins and pieces of scrap paper. All of these have some value because Picasso possesses authenticity, celebrity, and quality (when discussing his more formal works), but none of his napkins are going to reach Vermeer-level values.

Weltanschauung

The above is a more subtle word than “fashion,” which is what most people would refer to this context. Weltanschauung translated from the German means “worldview,” and the connecting factors that shape this view. It’s not just that digital art is currently fashionable, it’s that the spread of technology is changing our view of value, as bitcoin first demonstrated.

So why did someone pay $69M for a digital representation of a composite of 1500 images? And what, exactly, did they buy?

To dive a bit deeper into all this, we interviewed four participants in the rapidly evolving world of NFTs. They’re Athon Slotkin, known as The Shadow CEO, a specialist in working with new ventures and startups, Dean Christensen, a classically trained figurative painter who with Dapper Labs, Roham Gharegoziu, CEO of Dapper Labs, and Zachary Winterton, creator of Crypto Dunks, a retro (Atari)-themed collectible set of images of basketball dunks.

This question goes to Athon. Please tell me your definition of an NFT work of art and/or a collectible?

Athon. NFT art consists of ownership of the digital code for that art on a particular blockchain. Because an NFT can’t be recalled, the code can’t be cracked, and only one code can exist, you possess certified proof that you are the owner of that digital work.

Can you sell multiple copies of an NFT artwork a la a numbered lithographic series?

Yes, you can. In fact, NBA Top Shots does that with their digital card collections.

After purchase, all I get is the code?

No. You also obtain, unless there are contractual provisions to the contrary, all rights to the work as well. That’s key. Video, print, commercial, copyright, everything.

For example, if you buy a popular viral video and its ownership has been authenticated, then “certified” by the blockchain transaction, it’s yours to do with as you wish. Sell, withdraw from public access, do nothing with it. I believe that when “Zoe” was sold, there was speculation the video was going off YouTube, but apparently the owners are keeping it available, though the exact details are unclear. But they have the right to do that and demand everyone take that stream down. It was never entered into the public domain under any license, either digital or published. That’s scarcity. Zoe’s family has authenticated that they’ve sold the original stream.

But what about copying? There’s nothing to stop me from making a copy of the “Zoe” video and reproducing it as often as I want.

Yes, that’s true. In fact, digital technology makes copying much easier than ever before. You can create a digital scan of “Girl With a Pearl Earring” and reproduce it at a resolution so high the human eye could not distinguish the copy from the real painting. You could use that to create an oil-based work that not even an expert could tell was a facsimile without conducting tests on the pigment, frame, canvas, etc. Go hang a copy in every room in your house.

Now, try this experiment. Go to the Louvre in Paris and take “Pearl Earring” off the wall (it’s a very small painting) and place your digital reproduction in its place. This will be your chance to have an intimate relationship with a French jail. The reason this will happen is Vermeer’s masterpiece is authenticated beyond a shadow of a doubt as the original painting. Vermeer did not create your copy.

Here’s another experiment. Take your perfect digital copy of “Zoe” and post it on YouTube without permission or attribution. Then wait for the take down request (if they even ask you before removing it). Try to sell or rent it and you may be arrested for fraud.

It’s true that “Earring” is no longer copyrightable according to today’s IP laws, though a poster of the picture probably is. But that doesn’t really matter. In this case, authenticity, celebrity, quality and scarcity drive the painting’s value.

Then what’s the deal with CryptoPunk #6965? I just don’t see the quality. I never quite got Beanie Babies, myself. But I do know some of the rarer and more expensive pieces were counterfeited.

That’s another thing in favor of NFTs; once it’s been transacted on the blockchain, it can’t be counterfeited. As for quality, that’s in the eye of the beholder. I think that’s where weltanschauung enters the equation. At this moment, many people believe that NFTs are an important component of digital art. I don’t know what the future holds, but people are voting with their dollars.

But let’s look at the other factors in your list. Scarcity. NFTs by their nature create scarcity. Once the blockchain entry has been registered, no further transaction except between the owner and a purchaser can take place.

Ditto for authenticity. If the asset owner can prove authenticity, there are no further question. In both “Zoe” and “Bite” that milestone was reached years ago. Celebrity? Yes. both of these videos are well known and attract a constant stream of new viewers. Virality, a relatively new concept, is weltanschauung again.

Dean and Roham, can you tell me more about Dapper Labs? NBA Topshot? What are they?

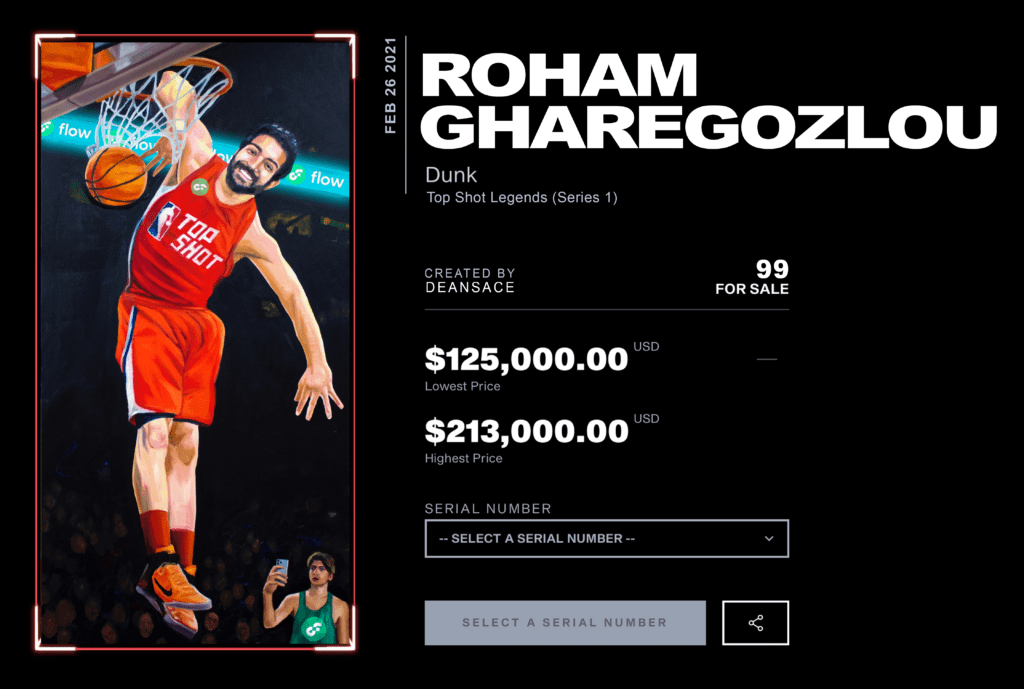

Roham: Dapper Labs was founded to monetize different aspects of the growing NFT market. NBA Top Shots was created in partnership with the NBA to create and offer different lines of digital products built around NBA content. Our principal product lines are our digital collectible card lines, which include player cards and “legendary” dunks. You have some samples featuring Dean and myself to see what we mean. (I can’t dunk, by the way. And neither of us are NBA players.) Our other main product is “Moments.” These are online streams of famous and memorable plays.

Sample cards are shown at the top of the page. They look just like playing cards.

They look that way, but those images are on the block chain. Yes, they can be digitally reproduced easily, but that doesn’t provide authenticity. That card belongs to you unless you sell it.

The NBA connection is very important. One reason they wanted to partner with us is that the NBA, as well as other major sports, is surprisingly reluctant to publish much of their content because of IP issues such as copyright and trademark. Blockchain relieves much of that concern. Yes, there’s plenty of content up on YouTube but there’s also plenty that isn’t. And monetization opportunities on YouTube are very limited.

And people within the NBA such as Mark Cuban like blockchain for reasons that go beyond added content monetization. For example, the technology enables you to create secure tickets that can’t be scalped. That’s a huge issue in professional sports and for any event-based business.

I don’t know. When I was a kid, I used to take baseball cards and stick them between the spokes of my bike to make that cool sound. They still do it in Virginia. I don’t think I can do that with a digital card.

Sure you can. You can print as many copies of your card on cardboard stock as you want. And when the cardboard has fallen apart, you’ll still have your digital card. And it will still be the only one. And don’t forget scarcity. How many thousands of cards has LeBron James has signed over the years? Aaron Judge? Tom Brady? And they’ll be signing them for decades.

OK, great. Let’s discuss “Moments.” I’ve bought a “moment.” Where do I keep it? Where can I sell it?

Dean: They can store their purchase on the Dapper Lab online “digital locker” and put it for sale on Amazon or Ebay. We charge a 5% commission on every sale. Now, if anyone wants to buy that version of LeBron James executing a particularly monstrous dunk, you can sell or license it. There are other exchanges, such as OpenSea online as well.

I see Dapper Labs has a game? KryptoKitties?

Roham: That’s our online virtual game! Terrific for kids and cat fanciers! Breed online furballs, uncover special abilities, create new types of cyberkitties.

Hmmm. In the 90s, I played a game called “Creatures” that did something like that. Also, my daughter owned a tamagotchi. A virtual critter that lived in a device. But your creatures died and so could your tomagotchi.

You don’t have to worry about that. With blockchain, your kitty assets will never die. Nor get moldy from being stored for years in an attic like so many Beany Babies did.

I take your point. But, my wife and I already own two cats courtesy of my daughter, whose big heart told her to bequeath them to her immediate family once her in-person carrying capacity for foundlings and strays reached its limits. I think KryptoKitties is one is for my granddaughter. In what other markets do you see crypto-art and NFTs becoming important?

I think we’re just scratching the surface. For instance, in your book, In Search of Stupidity: Over 40 Years of High-Tech Marketing Disasters, you mention being surprised about how limited the digital marketing was for Edge of Tomorrow, the very successful sci-fi flick starring Tom Cruise and Emily Blunt. You point out that the movie was based on the popular Japanese manga All You Need Is Kill and there were many opportunities for cross promotions that would have added to the film’s value. The movie was released before NFTs were appearing, but today it’s easy to imagine building some spin-off NFTs that tied the two works together, such as special artwork, perhaps a limited edition comic, perhaps a graphic novel.

The music group The Kings of Leon have generated over $2M in sales by releasing their latest album in a limited, alternative NFT version. It sold $50 per copy and bundled in a moving album cover, a limited edition vinyl version you could buy via a digital coupon, exclusive AV art, and front row seats at shows.

In Stupidity, I discuss how blockchain will revive the “used” book market. It allows digital books to be sold on a blockchain, then resold, with possibly a small but consistent royalty stream flowing back to the author. Right now, if you publish a book, for the author it’s one and done. I believe that soon all new books and similar publications will appear on blockchains. I also think NFTs will also create new promotional opportunities for books and other types of publications, a la the ideas I thought would work for Edge of Tomorrow.

Zachary: A very good point. We think the commercial future of bitcoin is in the new markets that NFTs open up.

Interested in entering the NFT market? The link below provides decent step by step instructions on the process. Please note that there are different virtual currencies and markets you may need to negotiate and understand. Please be aware that the convertibility of your virtual currency to “real” currency can change at a moment’s notice as of this writing, Also understand that the market’s acceptance of digital value in different industries is unstable and could bankrupt you rapidly if you’re not careful. I refer you to “Extraordinary Popular Delusions” and the Madness of Crowds and “tulipomania.”

https://www.cryptocoinsociety.com/guides/how-to-create-an-nft/

That said, bitcoin and NFTs are a paradigm change. They’re not going away